Indian Auto Component industry currently accounts for 1.87% of the GDP of country and Indian Automobile Industry

accounts for 7.1% of the GDP of the country.

Indian Auto component industry is expected to grow at a CAGR of

15% by 2020 due to increasing demand in domestic

as well as foreign markets.

About 72% of the

auto component industry in India is organized. NOVONOUS estimates that the

organized auto component industry in India is expected to grow at a CAGR of

12.5% by 2020. This sector supplies mainly to the OEMs.

The 2-Wheelers business which has 77.5% of market share is

expected to grow at a CAGR of 8% by 2020.

The passenger vehicles market which constitutes 15.1% of market

share is expected to grow at a CAGR of 18% by 2020.

The Commercial vehicles market will

grow at a CAGR of 19% by 2020 and that of Tractors will grow at CAGR of 27%

The new segment in which Auto component suppliers are dealing is

Construction and Earth Moving Vehicles this market will grow at a CAGR of 13%.

The industry

employees around 19 million people directly or indirectly, i.e. around 4.2% of

total employed workforce in India and this is expected to be 25 million by

2025.

This report

provides detailed analysis of the factors that have led to the growth of auto

component industry in India. The in depth study of the different segments of

automobiles, the new trends in the industry has been covered in this report.

The report further

discovered that there is large scope for exports, diversification as well as

aftermarkets for the organized players. It also focuses on the future growth of

the companies.

The report

emphasizes on the policies governing the Auto component industry in India and

the regulations and standards to be followed and maintained.

The report also has

detailed company profiles including their position in auto component value

chain, financial performance analysis, product and service wise business

strategy, SWOT analysis and key customer details for fifteen key auto component

manufacturers in Indian market namely Lumax Industries Ltd. (Lighting Solutions

Provider) [BSE: 517206 | NSE: LUMAXIND ], Wheels India Ltd. (Wheels

Manufacturer) [NSE: WHEELS], Minda Industries Ltd. (Automotive Security Systems

Provider) [NSE: MINDAIND], Mahindra CIE Automotive Ltd. (Forging Works) [NSE:

MAHINDCIE], Bharat Seats Ltd. (Automotive Seats Manufacturer) [BSE: 523229],

Sundram Fasteners Ltd. (Fasteners Manufacturer)

[NSE: SUNDRMFAST], UCAL Fuel Systems Ltd. (Fuel Management Systems

Provider) [BSE: 500464 | NSE: UCALFUEL], Exide Industries Ltd. (Battery

Manufacturer) [BSE: 500086 | NSE: EXIDEIND], Rockman Industries Ltd. (Die

Casting, Automotive Chain Manufacturer), Rane Holdings Ltd. (Steering gears,

Engine Valves manufacturer) [BSE: 505800 | NSE: RANEHOLDIN], Bajajsons Ltd.

(Engine parts Manufacturer), Lucas TVS (Automotive Electrical Systems

Providers), CEAT (Tyre Manufacturer) [BSE: 500878 | NSE: CEATLTD], JBM Auto

Ltd. (Sheet Metal components Manufacturer) [BSE: 532605 | NSE: JBMA], India

Pistons Ltd. (Piston, Piston Rings Manufacturer)

Under the EXIM scenario, the report

covers 15 major auto components, which are:

Halogen Lamps for

Automobiles, Spark Plugs for Automobiles, Automobiles Lighting Equipments, Automobile

Bumpers and Parts, Automobile Safety Seat Belts, Automobile Brakes and Servo

Brakes, Automobile Gear Boxes, Drive Axles With Differential W/N Provided with

Other Transmission Components, Road Wheels and Parts and Accessories, Suspension

Shock Absorbers, Automobile Radiators, Automobile Silencers and Exhaust Pipes, Automobile

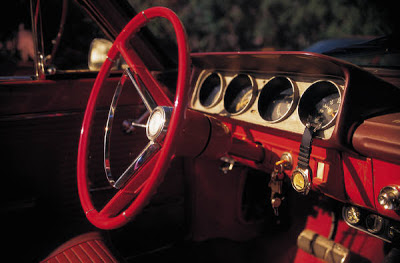

Clutches and Parts, Automobile Steering

Wheels, Steering Columns and Steering Boxes and Safety Bags with Inflater

System.

Scope of Auto component industry in

India 2015 – 2020 report:

- This report provides a detailed view of Indian Auto component sector with current and future market trends.

- This report identifies the need for focusing on Auto component industry in India.

- This report provides detailed information on growth forecasts for overall Auto component industry in India up to 2020.

- This study also identifies segment-wise Auto component industry potential and forecasts in organized sector for Passenger vehicles, commercial vehicles, 2-Wheelers, 3-Wheelers and Tractors.

- This report also focuses on developing a better understanding of the current state of the Auto component industry.

- This study also identifies various central and state policies related to auto component industry in India.

- This study also focuses on the work of various associations to facilitate the growth of the industry.

- The report identifies the growth drivers and inhibitors for Auto component industry in India.

- The report identifies the key credit, policy and technological risks associated with Auto component industry in India.

- The report profiles 15 key players in Indian Auto component industry.

- This report provides competitive landscape in Indian Auto component industry.

- This report identifies EXIM scenario of the Indian Auto component industry.

- The report identifies the key challenges faced by new players in Indian Auto component industry.

- This report provides future trends and opportunities for Auto component industry in India.

- This report covers the Case study of Tata Nano.

- This report also provides recommendations for policy makers, service providers, end users and investors.

For

more information and purchase this report please visit:

To

browse more market research reports by NOVONOUS visit:

No comments:

Post a Comment